this post was submitted on 03 Feb 2025

90 points (100.0% liked)

InsanePeopleFacebook

3374 readers

4 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

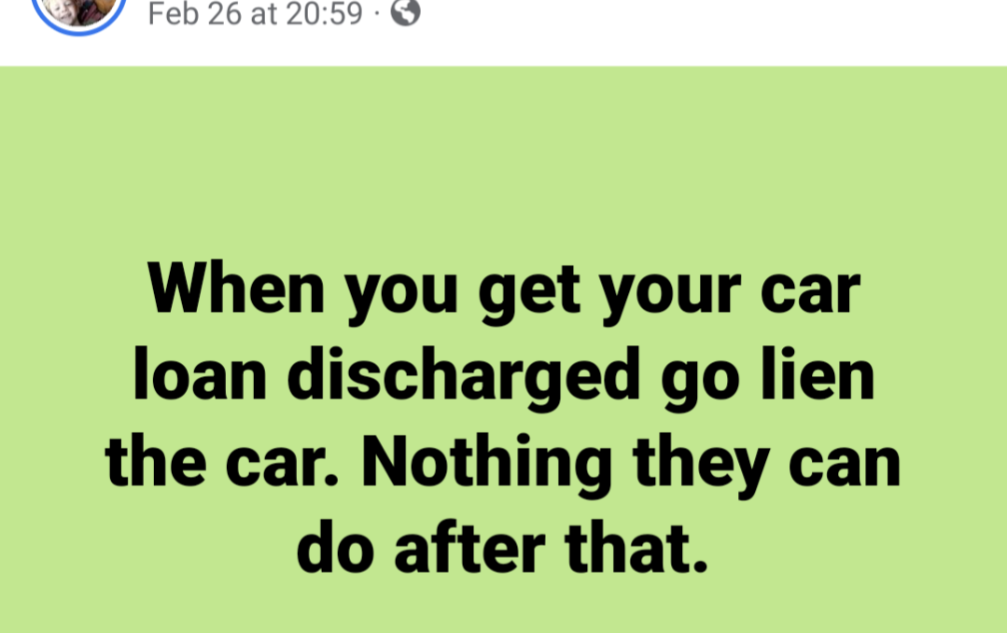

That doesn't even make any sense.

Presumably saying that if the loan is discharged that means there is no longer a lien on it. Putting one on it yourself (if that is possible?) might prevent creditors from using the courts to repossess it to get their money back. In reality the best it might do is to make them think it isn't an asset they can come after you for if they don't look close enough at the lien holder.

If there’s no lien on the car, nobody can repo it. “Go lien the car” isn’t even a thing, and fails to specify who the lien holder would be.

If you owe money they can still sue you and the court can force you to turn over assets.

There are some protections around the court taking away your primary residence, but I don't think there is anything stopping them from taking away automobiles (likely varies state to state).

So I wasn't talking about the original lein holder repossessing th vehicle, but instead other creditors that now see assets that are open on the books and seeking legal action to get their money back. Unlikely they will want to pay lawyers to do that for your car, but still possible.