this post was submitted on 22 Feb 2025

1405 points (100.0% liked)

Enshittification

2320 readers

5 users here now

What is enshittification?

The phenomenon of online platforms gradually degrading the quality of their services, often by promoting advertisements and sponsored content, in order to increase profits. (Cory Doctorow, 2022, extracted from Wikitionary) source

The lifecycle of Big Internet

We discuss how predatory big tech platforms live and die by luring people in and then decaying for profit.

Embrace, extend and extinguish

We also discuss how naturally open technologies like the Fediverse can be susceptible to corporate takeovers, rugpulls and subsequent enshittification.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

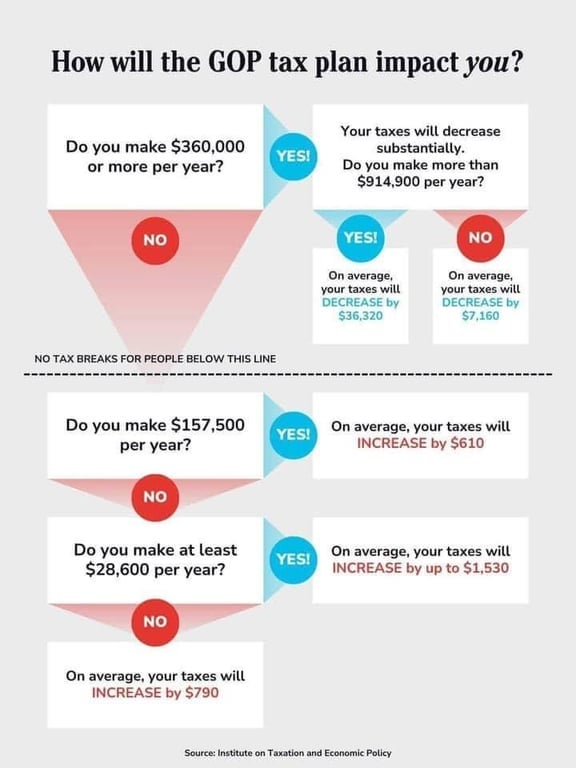

That's like 5.3%, could that be real? That would be ridiculously low. I just checked and with that same income I'd be paying 2480 in Germany, or 8.3%, and that's in taxes alone. After social insurances and health insurance the total deduction would be 6450 or 21.5% total.

I can’t say anything about the validity of the infographic but it says “increase up to” so it’s relative not absolute. So without knowing the current taxation it would be hard to say that tax is low, unless you think the increase is too low. Or am I missing something?

The text from the OP below the infographic was my point of reference, not the graphic itself.

Ah, I get now what you mean. Fair point.

I'm speaking from the perspective if you're that close to or under the poverty line it does not help society to tax you any amount.

Google says the poverty line in the US is 13800, what am I missing?

The actual real poverty line is going to be region dependent. If you grow up in a high income area and end up "only" making 30k a year before taxes, then you'll be either living with your parents or in your car.

As to why 1500 dollars extra taxes will break families earning 30000 a year: people and especially families have fixed expenditures needed to survive. After other taxes, rent, food, ... there is usually nothing left at the end of the month. Where are these people going to save 1500 dollars? So don't look at it as 1500 out of 30000, look at it as taking 1500 dollars from someone who has 0 dollars left.

Edit to add: that 1500 is not total taxes, it's extra taxes.

The point is to make living in America under the current administration so shitty that people will revolt. Justifying a crackdown, in which hundreds of thousands, if not millions, will die or be incarcerated. And depending on who is backing the revolt, their ideology will replace the current one. And either way, the system of boots and faces will continue.

Rules of exponents.

Or maybe just real world living.

To add to the below reply, it also depends on where you live. The poverty line in California is vastly different from someone in Oklahoma, because our rate of living wage is different. The 13800 (for a single person) sounds roughly like Oklahoma because our median wage is roughly 50000.

Edit: whoops, actually we go by the federal poverty line which is 15650

https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

That's not the total, that's how much the taxes will increase by. So $1600 on top of whatever you're currently paying. Most of that will be in the form of tariffs on pretty much any goods you buy that aren't made within the country.

LOL to the moon. Factor in the cost of healthcare, a long vacation, a maternity leave and education here. Bet that would cost you WAY over 21.5% here.

Do you have local taxes? We have state taxes, house taxes, etc, so not sure what the equivalent would be.

We have property taxes and VAT/GST, though the latter are federal. Property taxes vary by district, not justby state or even city. That's a bit of a hot mess.