this post was submitted on 29 Apr 2024

1129 points (100.0% liked)

Political Memes

8164 readers

2196 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

No AI generated content.

Content posted must not be created by AI with the intent to mimic the style of existing images

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

In Canada, a company-provided vehicle is a taxable benefit when used for personal purposes. This can include if you park the vehicle at home and drive to/from work if you have a fixed office location.

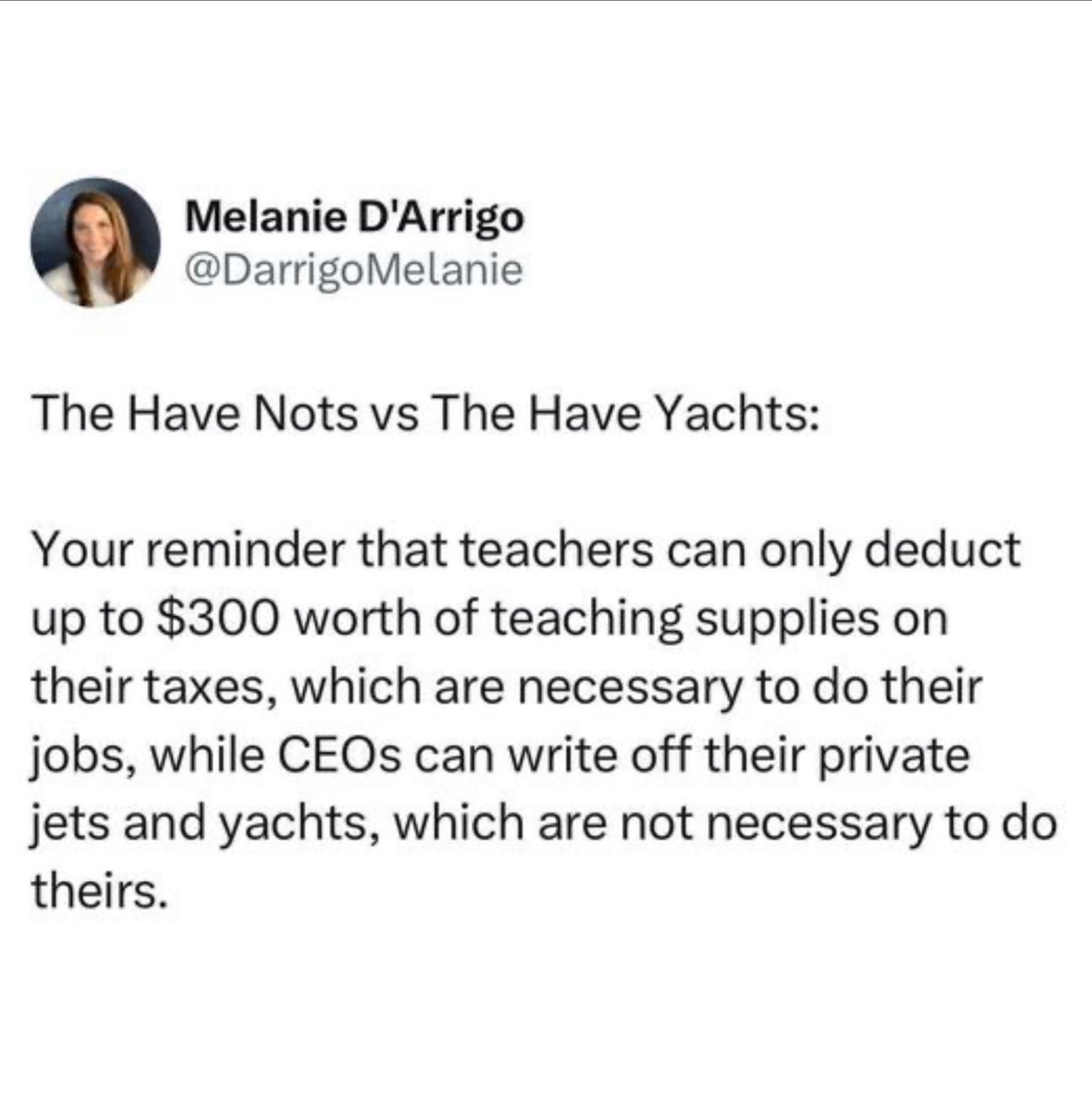

Of course, the rich work around this by making that yacht trip etc a "business expense" and entertaining similarly rich guests.

Still fraud, just not investigated

So many people think "tax deductible" literally means you subtract it from your taxes.

It's still a hefty discount

"Tax creditable" just doesn't have the same ring.

Might as well be, if they use it for work it counts. My boss bought a luxury RV for our company, he's the only one whose ever used it but technically there is a contract if a customer wants to rent it. Not that anyone was ever instructed to actually shill it.

That means it's a business expense, not that you can literally deduct 100% of it from your taxes.

That's fraud, you can report it to the IRS

Unless you work from home, then you are expected to have the space, supplies, desk, chair, electricity, internet connection...

Not really. The company should pay for everything you need to do your job.

Yeah they should but that's not how it works now.

It is in a sane state like California.

Check with your boss/HR. My partner works for a University, and they have received an ergo mouse, chair, and motorized adjustable desk for their home office simply by requesting them. Most organizations have a budget for IT accomodations and they hardly ever use it.

Also, if you can get a Dr's note for it, most places will purchase just about any accomodations you need for work. Larger monitors, ergo keyboard, dictation software...etc...

They're not "allowed to" expense those things. At least, not in the way you mean. Whether or not regulators have an appetite to investigate is another matter.

In my opinion, companies shouldn't be allowed to expense anything. The entire concept is pointlessly complicated and only serves to favor businesses that can afford to hire teams of accountants. The law doesn't encourage any kind of value adding on the slightest, it's just a game to save money.

There are complicated parts of accounting, but basic expense tracking is simple and businesses would do it even if it didn't affect their tax treatment.

If businesses couldn't write off expenses, it would be nearly equivalent to treating the corporate income tax as a universal sales tax. This would be incredibly damaging to small businesses and benefit behemoth vertically integrated companies, which is probably the exact opposite of what you want.

If you get rid of expenses, you need to get rid of corporate income tax and either replace it with VAT or combine it with increases to personal income tax like taxing capital gains as ordinary income.

Mmmm that's a great point about vertical integration, I forgot about that.

That would basically guarantee that no new business ever survives.

Companies shouldn’t be paying taxes at all. Just tax the people who own the companies directly based on the value of their shares.