Comic Strips

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- [email protected]: "I use Arch btw"

- [email protected]: memes (you don't say!)

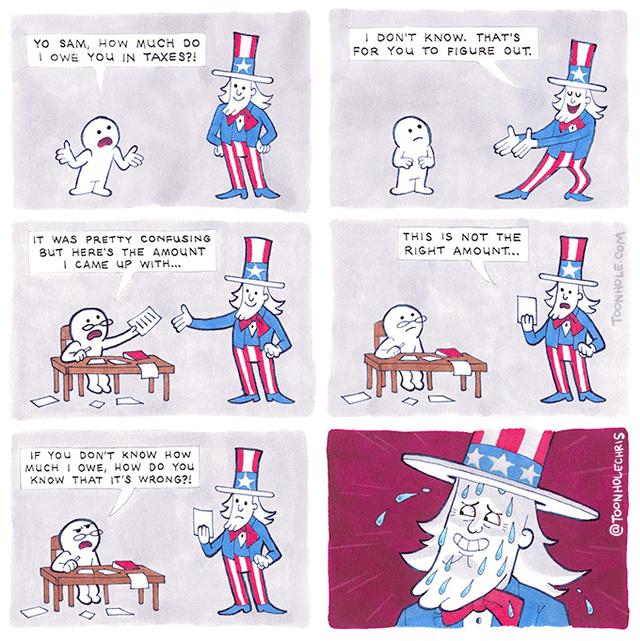

As a Brit, I always assumed the American system worked like that because of freedom or something.

All employers report income and deduct taxes from paychecks directly, so the government knows how much you have paid.

What they don't know is if you've won a lottery, sold a service or have someone bunking at your place paying rent. This you need to declare yourself.

In the UK the rule is: we will assume you have nothing else, please let us know if you have additional income

In the US (and Canada) the rule is: we will assume you have a lot of shit, please let us know even if you don't have additional income.

The US system stems from Conservatives having nothing other to run on than "people are going to grift and if you're an honest employed american you have nothing to worry about". Which is a measure that mostly affects the poor and those who don't know the law.

The same reason healthcare was tied to employers. They convince people nothing could go wrong because only those working should have healthcare. Which we can all see is insane but looks good on paper.

(lottery is probably a bad example – both US and Europe, lottery winnings are more heavily tracked and reported than sales or income tax)

well … if capitalism means freedom, then … yes?

I will die for my freedom to be fucked over by corporations.

Knowing the correct solution and knowing whether or not a solution is correct are not the same thing. Doesn't really apply here, but it's important to remember.

Brushing your teeth regularly will help prevent cavities. Doesn't really apply here, but it's important to remember.

One is completely unrelated. Care to try again?

Calm down and learn to take a joke.

Jokes are funny. They subvert expectations or play on words and phrases.

Soooo quirky

Well I liked it!

0..9999999 | Where-Object { Test-ValidTaxReturn $_ } | Select-Object -First 1

dude just casually in here solving p=np

You are correct that it doesn't apply here. So why say it?

It’s relevant, just not on point.

In Belgium its almost completely hands-off

It gets calculated for you, although you can check it if you like to make sure.

It usually is correct, in which case you don't have to do a thing.

Likewise in the UK for standard wage workers. Only gets more complicated if you have investments outside and ISA or multiple sources of non-labour income.

I never understood why there wasn't a federal web site where you input your gross based on W2. Then check off boxes for special deductions like kids. And wamo here's what you owe. But if our tax system was simple and stupid than thousands of people at IRS wouldn't have jobs. Too bad. Let them find other jobs.

it’s ~~corruption~~ lobbying by TurboTax

The IRS are the good guys.

TurboTax and HR Block are the ones making it a shitfest.

Good guys, no. Workers doing a job with no more malice than anyone else, sure.

“thousands of people at IRS wouldn’t have jobs”

or they could start going after the actual tax cheats (wealthy and corporations) instead of hassling regular workers barely scraping by

The IRS is (supposedly) under funded. That's (supposedly) why they can't actually go after the rich people and business. They can't afford the legal fees.

The reason there's no federals site is corporate lobbying. You see if there was federal site, business like Turbo Tax and HR Block would fail. They convinced the government "let us take care of the online platform", the gov said "okay, but as long as you make a free service for low income people".

Then the corps branded the free version a different name, burried it and advertised the paid one. Then they filled the service with all kinds of dark patterns to get people to pay for crap they don't need. Government hasn't done anything about it.

I had to decline "upgrading" to a paid tier 6 times while filing NY taxes through HR Block this year.

Try freetaxusa.com the only fee I've ever been charged is $15 to file state taxes. Fed is free.

Recently in Brazil we basically just have to hit a button on a web application. It's definitely a little more complicated if you are a business owner.

One of the promises I wish he would have kept. Back when presidents actually did some of the things they promised.

This would be a lot funnier without the last two panels.